Depreciation recapture formula

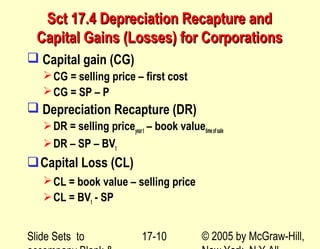

Tax depreciation generally does not conform to book depreciation. The ordinary income assets consist of unrealized receivables and inventory items that have appreciated substantially in value1 An explanation of these assets follows.

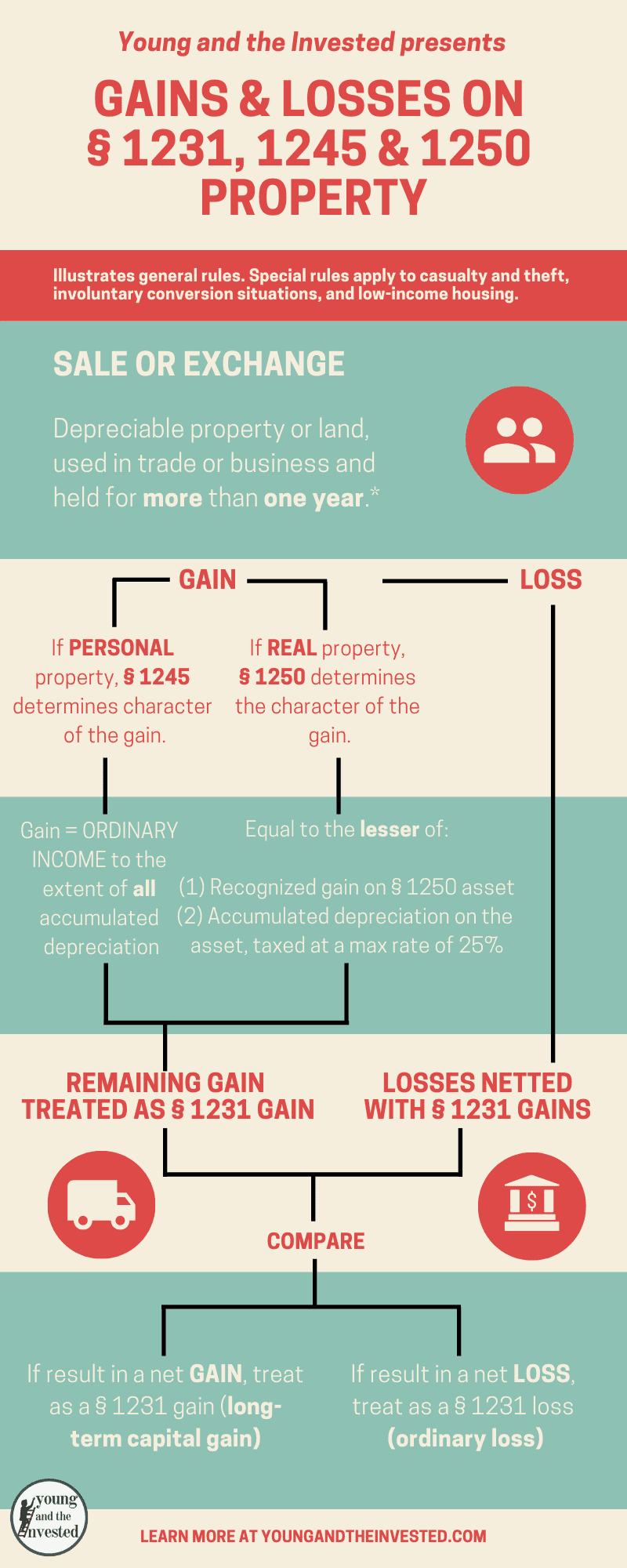

Capital Gains And Losses Sections 1231 1245 And 1250

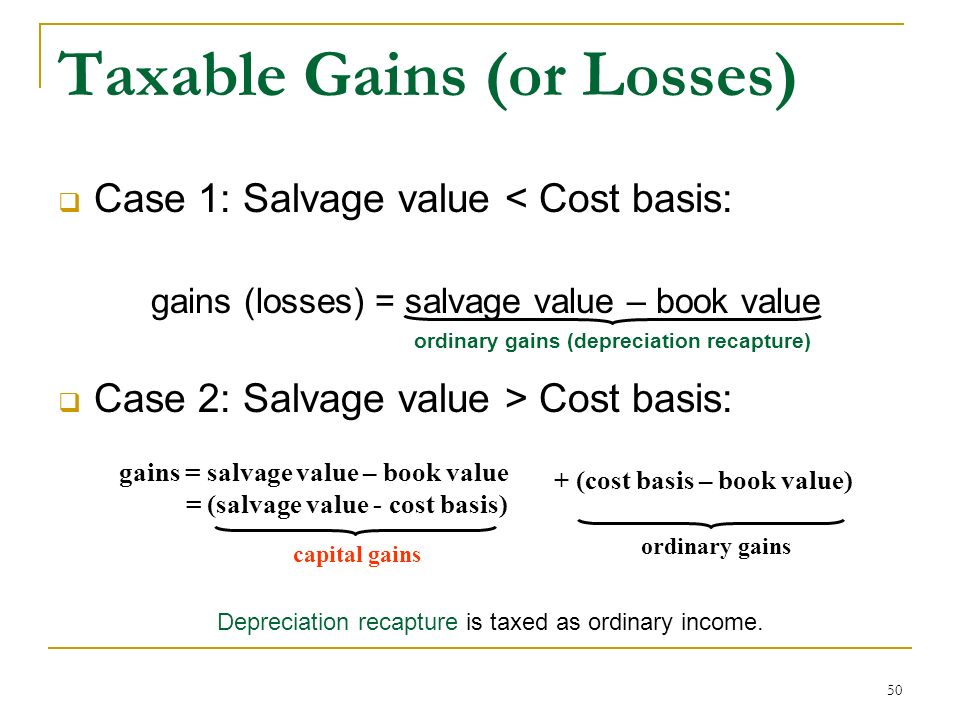

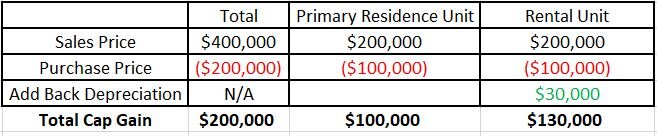

The increase in value over the original purchase price.

. Wouldnt it be great if you could speed up your depreciation deductions. Distributive share of income Cryptoasset clarity needed for private fund managers State PTE elections. The cost of most intangible assets is capitalized and amortized ratably over 15 years.

The credits subtracted in calculating net Colorado tax liability consist of all refundable and. Any depreciation on a corporate income tax return other than Form 1120-S. In other words youll have to wait 275 years to deduct the full cost of your rental buildings.

Or assessment minus any credits allowed. The recapture of depreciation previously taken. The 150 percent depreciation rate is calculated the same way as the straight-line method except that the rate is 150 percent of the straight-line rate.

163j in Relation to the Excise Tax ET-5 - Deductible Business Interest Expense Carried Forward from Tax Years 2018 and 2019. The commenter suggested that routine but de minimis sales of electricity to the grid could cause a CHP to be subject to depreciation under one of the MACRS classes listed in 145Q-2e of the proposed regulations thus triggering the 500000 metric ton threshold applicable to carbon capture equipment installed at electric generating. If that sounds complicated it isbut well provide examples later.

Amortization of costs that begins during the 2021 tax year. You can avoid depreciation recapture altogether through a 1031 exchange. The formula in new paragraph 132531a when adapted in accordance with new subparagraph 132531.

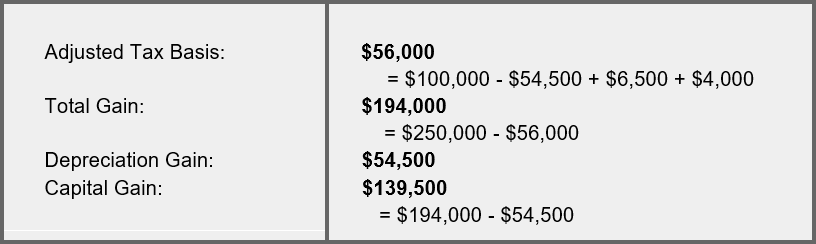

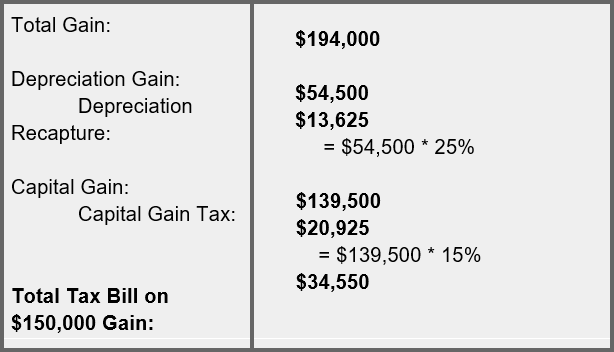

For this calculation total tax includes Colorado income tax and any recapture of prior year credits. Cash capital assets and 1231 assets to the extent in excess of depreciation recapture and generally any assets the sale of which produce capital gains or losses. In the example above if Jane had taken 10000 in.

The formula for calculating real estate value based on discounted net operating income is. Calculating Depreciation Using the 150 Percent Method. The depreciation recapture would be recognized in the year the primary residence is sold even if the homeowner qualifies for the 121 exclusion.

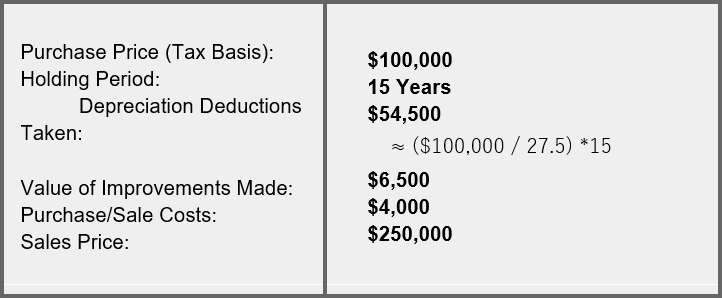

Decreases to basis include depreciation and casualty losses. To calculate use this formula. The straight-line depreciation formula is.

In the sale or exchange of a portion of a MACRS asset discussed later the adjusted basis of the disposed portion of the asset is used to figure gain or loss. Gain is allocated using a formula or fraction based on the number of years the property was held for qualified use versus the number of years the property was held for non-qualified use as a. Summary of recent proposed regulations Guaranteed payments vs.

A 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred and paid at a later time. Further tax depreciation generally is subject to recapture on the sale or disposition of certain property to the extent of gain which is subject to tax as ordinary income. Sell Your Commercial Property.

It gives larger depreciation figures at the beginning. So he will pay capital gains on 50000 profit. The tax deferred price is based on the following formula 43 x CEC 1971 Value where the CEC is the cumulative eligible.

MACRS declining balance changes to straight-line method when that method provides an equal or greater deduction. Commercial Property Selling Tips. Share in a ratio.

The formula is the cost of the property divided by its useful life. Record the annual depreciation. ET-3 - Federal Section 179 Depreciation is Deducted for Excise Tax ET-4 - Interest Expense Limitation of IRC.

Starting net book value x Depreciation rate. Ratio Write as a ratio. The total amount of depreciation you claimed during the rental period is not eligible for the exclusion.

Depreciation recapture allows the IRS to collect taxes on the sale of an asset that a business had previously used to offset its taxable income through wear tear and operating expenses. The first-year depreciation deduction allowed for new luxury autos or certain passenger automobiles acquired and placed in service in 2010 through 2020. Then the depreciation figures decrease as time goes by.

The terms used in the preceding formula have the following meanings. The depreciation period for residential rentals is 275 years. A deduction for any vehicle reported on a form other than Schedule C Form 1040 Profit or Loss From Business.

Depreciation recapture in the partnership context Estate planning update. Unfortunately depreciation for residential rental property is particularly slow. Recapture premiumaccounts for net land appreciation.

While this is often called a capital gain technically only capital property can generate a capital gain. In periods where corporate tax rates were significantly lower than individual tax rates an obvious. Direct proportion Currency conversion.

Depreciation for 2009 using Table A-1 is 100 million 20 20 millionDepreciation in 2010 100 million - 20 million 15 200 32 millionDepreciation in 2010 using Table 100 million 32 32 million. Depreciation on any vehicle or other listed property regardless of when it was placed in service. But note that he must recapture the depreciation and pay taxes on 100000 at.

Again the straight line formula is the most common method for calculating. Use of ratio. Whether or not patented and a secret formula.

Instead you must recapture all your depreciation deductions--that is report them on IRS Schedule D and pay a flat 25 tax on these deductions. Subsection 132 provides that depreciation recapture in respect of a passenger vehicle is not required to be included in income under subsection 131 if the vehicle has a cost in excess of 20000 or such other amount as may be prescribed. There are a few things to note here.

40000 net operating income 7 capitalization rate 571428 sales price. A formula sheet will be provided for foundation tier and higher tier students. By using the formula.

A big picture perspective. Taxes depreciation and amortization. When you buy an asset like a.

Over the years he had deducted depreciation in the amount of 100000. This can have a significant tax impact. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends with the purpose of avoiding shareholder-level tax seeSec.

Can You Do a 1031 Exchange and Avoid Depreciation Recapture. You may have to report the recognized gain as ordinary income from depreciation recapture. Credit Carryover and Recapture Summary to figure the amount of credit unless the corporation is required to complete Schedule P 100.

Use the double-declining balance depreciation rate which is double that of the straight-line depreciation rate. Depreciation cost - salvage value years of useful life.

1031 Exchange And Depreciation Recapture Explained A To Z Propertycashin

Like Kind Exchanges Of Real Property Journal Of Accountancy

Depreciation Starting With The Basics Ilsoyadvisor

Learn About Depreciation Recapture Spartan Invest

How To Use Rental Property Depreciation To Your Advantage

Contributed Property In The Hands Of A Partnership

Solved A Property Purchased For 100 000 With An Noi Of 7 000 Per 10 Years Will Be Sold For 140 000 There Is No Cost Of Sale Depreciation Taken Course Hero

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Learn About Depreciation Recapture Spartan Invest

Do I Have To Pay Tax When I Sell My House Greenbush Financial Group

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Learn About Depreciation Recapture Spartan Invest

Depreciation And Income Taxes Asset Depreciation Book Depreciation

Depreciation And Income Taxes Prezentaciya Onlajn

Chapter 8 Depreciation And Income Taxes Ppt Video Online Download

Chapter 17 After Tax Economic Analysis

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download